Answer:

$1,991 will be the total annual out of pocket expenses in the event of a major mishap.

Explanation:

The given information is :

Amount of insurance policy = $ 355,000

Annual premium = $ 0.42 per $100

Deductible amount = $ 500

Then the total annual out of pocket expense will be =

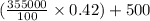

=>

=$1991

=$1991

Therefore, $1,991 will be the total annual out of pocket expenses in the event of a major mishap.