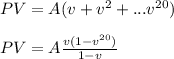

Use present value equation.

If present value of annuity equals 400,000, then you are indifferent.

where v = 1/(1+r) and A = annual payment = 800,000/20 = 40,000

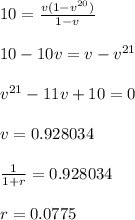

PV = 400,000

After subbing in the numbers, the equation is:

Therefore at interest rate of about 7.75% you are indifferent.