Answer:

b. $456.20 is the answer.

Explanation:

The cost of the mattress = $1255

APR of the credit card = 11.56% or 0.1156

Time = 2.5 years

n = 12

Sales tax in Nicole's area = 9.08% or 0.0908

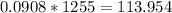

So, sales tax amount =

Total amount becomes(p) = 1255+113.954 =$1368.954

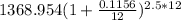

Compound interest formula =

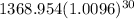

Putting above values in the formula:

= $1823.351

So, interest paid becomes = 1823.351-1368.954 = $454.397 closest to $456.20

Hence, option B is the answer.