Answer:

Monthly payment is = $1006.75 approx

Explanation:

The price or principle is = $169000

time or n = 30*12=360

rate = 5.95/12/100=0.00495

The EMI formula is given as:

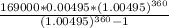

Now putting the values in the formula we get,

Monthly payment is = $1006.75 approx