Answer:

Cynthia will have to pay $152.16 extra due to increase in her APR.

Explanation:

The EMI formula is =

Scenario 1st:

p = 3265

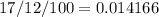

r =

n = 24

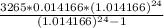

Putting the values in the formula:

= $ 161.44

Scenario 2nd:

p = 3265

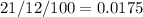

r =

n = 24

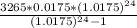

Putting the values in the formula:

= $ 167.78

The difference between these two are :

per month

per month

So, for 24 months, the charge will become =

dollars.

dollars.

Therefore, Cynthia will have to pay $152.16 extra due to increase in her APR.