Answer:

The debt-to-income ratio is 13:60

Explanation:

Owen makes $3,000 per month.

He spends $300 on credit card payments and $350 on an auto loan.

Debt is amount whose amount paid by Owen.

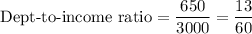

Total monthly Debt = Credit Card Payment + Loan payment

= 300+350

= $650

Total monthly Income = $3000

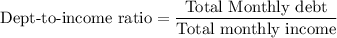

Substitute into formula

In percentage 13:60 = 21.67% ≈ 22%

Hence, The debt-to-income ratio is 13:60