Answer:

I will owe $4250 in federal taxes this year.

Step-by-step explanation:

If we want to solve this exercise, we need to calculate the 10% of $42500.

To do this, we know that exist a direct linear relationship between the money and the percentage. This means that for a greater amount of money the percentage will be higher. We can write :

Where the denominators ''100'' and ''10'' are percentages.

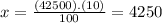

Solving for x :

x = $4250

We find that 10% of $42500 is $4250.

I will owe $4250 in federal taxes (assuming that I have no deductions).