Answer:

Option 2 -$852

Explanation:

Given : You have decided to buy a new home and the bank offers you a 30 year fixed loan at 5.5% on a balance of $150,000.

To find : The monthly payment?

Solution :

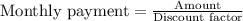

Formula of monthly payment,

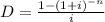

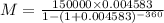

Discount factor

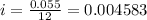

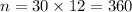

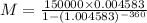

Put the value,

Where, A=$150000

r=5.5%=0.055

t=30 year

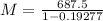

Substitute all the values,

Approximately, Monthly payment is $852.

Therefore,Option 2 is correct.