Answer:

$1203.20

Explanation:

Given : Anna has a house with a market value of $128,000

To Find: If the assessment rate is 40% of the tax rate per $100 is $2.35 how much will she owe annually in real estate tax,to the nearest cent?

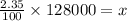

Solution:

We are supposed to find the assessment rate is 40% of the tax rate per $100 is $2.35 how much will she owe annually in real estate tax,to the nearest cent.

A.T.Q

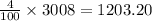

Now we are given that the assessment rate is 40% of the tax rate .

So. 40% of 3008 =

Hence she will owe $1203.20 annually in real estate tax,to the nearest cent.