Answer:

The answer is : C= $73,367.11

Explanation:

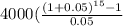

We will first find the future value of the annuity.

The formula is :

Fv = pmt [(1+r)^(n)-1)÷(r)]

pmt = $4000

r = 5% or 0.05

n = 15 years

Putting these values in the formula, we get:

= $86,314.25

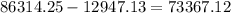

Now we will deduct the 15% tax on 86314.25 from $86,314.25

![[(86314.25)-(86314.25*0.15)]](https://img.qammunity.org/2018/formulas/mathematics/high-school/xuvslf4zojqiyiqg4rk3eg5egf1b4myu86.png)

close to option C.

close to option C.

So, option C is the correct answer.