Answer:

Credit card A offers better deal for the consumer.

Explanation:

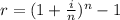

Since, the effective rate of interest is,

Where, i is the stated annual rate,

n is the number of number of compounding periods,

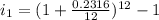

For card A,

i = 23.16 % = 0.2316,

n = 12, ( 1 year = 12 months )

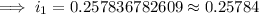

Thus, the effective interest rate,

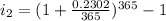

While, For card B,

i = 23.02 % = 0.2302,

n = 365, ( 1 year = 12 months )

Thus, the effective interest rate,

Since, 0.25784 < 0.25876

Hence, credit card A offers better deal for the consumer.