Answer:

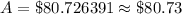

$80.73.

Explanation:

We have been given that you invest $50 a month in an annuity that earns 4.8% APR compounded monthly. We are asked to find the amount of money in account after 10 years.

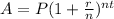

We will compound interest formula to solve our given problem.

, where,

, where,

A = Amount after t years,

P = Principal amount,

r = Interest rate in decimal form,

n = Number of times interest is compounded per year,

t = Time in years.

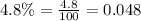

Let us convert our given interest rate in decimal form.

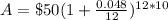

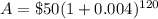

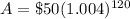

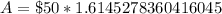

Upon substituting our given values in above formula we will get,

Therefore, we will have $80.73 in the account after 10 years.