Answer:

The Changs family paid the correct amount for their purchases.

Step-by-step explanation:

Given : The Changs updated their bedroom by purchasing a new lamp for $89.95 and a comforter set for $239.99.

They paid 6 3/5 % sales tax on their purchases.

To Find: If the Changs paid $351.72 total, determine if they paid the correct amount.

Solution:

Cost of lamp = $89.95

Cost of comforter set = $239.99

Total cost = $89.95+$239.=$329.94

Now They paid

sales tax on their purchases.

sales tax on their purchases.

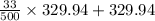

So, Total cost including Sale tax =

=

We are given that the Changs paid $351.72 total

So, Option D is correct.

The Changs family paid the correct amount for their purchases.