Answer:

a. The monthly payment is approximately $2,751.62

b. The total of all monthly payment for the 30 years is approximately $990,582.175

c. The finance charge is approximately $615,582.175

d. The interest is greater than the original cost of the home

Explanation:

a. The given parameters for the mortgage are;

The principal amount of the home Fernandez family is buying, P = $375,000

The number of years mortgage they take buy the home = 30 years

The percentage rate of the mortgage, r = 8%

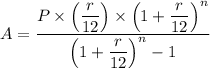

The monthly payment, 'A', for the mortgage is given as follows;

Where;

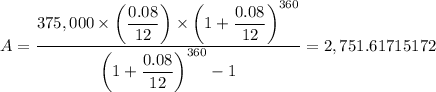

n = The number of monthly payments = 30 years × 12 months/year = 360 months

Therefore, by substituting the known values, we have;

The monthly payment, A = $2,751.61715172 ≈ $2,751.62

b. The total of all monthly payment for the 30 years = 360 × $2,751.61715172 ≈ $990,582.175

c. The finance charge = The total amount repaid - The amount that was financed = The interest payed on the amount financed

∴ The finance charge = $990,582.175 - $375,000 ≈ $615,582.175

d. The interest (approximately $615,582.175) is greater than the original cost of the home ($375,000)