Answer:

The market value to the nearest cent is $133,312.43.

Explanation:

Given is :

Jack and Brenda Bushnell pay $2,870.19 in annual property taxes.

The rate of assessment for their tax district is 54% or 0.54.

Tax rate is = 39.87% or 0.3987

Let their property’s market value be = P

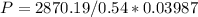

We can find P as :

P = $133,312.43

Hence, the market value to the nearest cent is $133,312.43.