Answer:

Total finance charge be when the loan is repaid is 1154832 cents.

Explanation:

Given : Paul has an eight-year loan with a principal of $26,900. the loan has an interest rate of 8.18%, compounded quarterly. if Paul pays $1,527 in service charges and makes quarterly payments on his loan

To find : What will his total finance charge be when the loan is repaid? Round all dollar values to the nearest cent.

Solution :

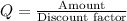

Quarterly payment,

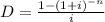

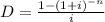

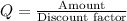

Discount factor

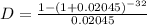

Where, Amount = $26,900

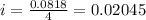

Rate r= 8.18%=0.0818 compounded quarterly

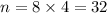

Time = 8 years

Now, put all the values we get,

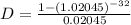

Quarterly payment,

Now payment he has for for 8 years compounded quarterly i.e, for 32 months

Payment = 1153.76 × 32 = $36920.32

Total interest = Payment - amount

= 36921.32 - 26900

= $10021.32

Finance charge = Total interest + service charge

= 10021.32 + 1527

= $11548.32

1 dollar = 100 cents

$11548.32 = 11548.32 × 100 = 1154832 cents

Total finance charge be when the loan is repaid is 1154832 cents.