Answer:

Hence, the new country's GDP have to be 20 trillion dollars in order to maintain the current debt to gdp-ratio.

Explanation:

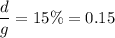

if a country's debt-to-gdp ratio is currently 15%.

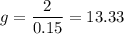

If the current debt(d) is 2 trillion dollars, then the initial GDP(g) must be

Here d=2

Hence

Hence, the current GDP or initial GDP is 13.33 trillion dollar.

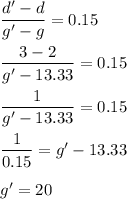

Now after 5 years the debt is expected to be 3 trillion dollars i.e. d'=3 trillion dollars.

Let the new GDP be denoted by g'

Hence,

Hence, the new country's GDP have to be 20 trillion dollars in order to maintain the current debt to gdp-ratio.