Answer:

The answer is: $39,748.80

Explanation:

The principle amount is p = $1600

rate is 10% or 0.10 but as its compounded semiannually it becomes,

= 0.05

= 0.05

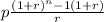

n =

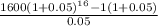

=16

=16

Formula is :

Putting values in formula we get

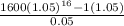

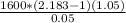

= 39748.80

= 39748.80

The value of the annuity due is $39,748.80