Answer:

The answer is $15,574.

Explanation:

A warehouse manager earns an annual salary of $65,700, and he contributes $5800 per year to his 401(k) plan.

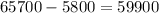

Now, the pretax income becomes =

dollars.

dollars.

Now, multiplying the percentage withheld for taxes by the pretax income to get the manager's income tax withholding.

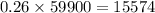

This becomes :

dollars.

dollars.

Therefore, the answer is $15,574.