Answer:

Loan A and B

Explanation:

Since, the effective annual interest rate is,

Where, r is the nominal rate( in decimals) per period,

n is the number of periods,

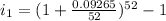

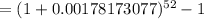

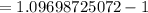

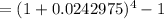

In Loan A :

r = 9.265% = 0.09265,

n = 52,

Thus, the effective annual interest rate is,

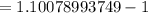

In Loan B :

r = 9.442% = 0.09442,

n = 12,

Thus, the effective annual interest rate is,

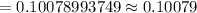

In Loan C :

r =9.719% = 0.09719,

n = 4,

Thus, the effective annual interest rate is,

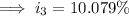

Since,

,

,

but

but

Hence, Loan A and B meets his criteria.