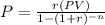

To solve this we are going to use the monthly payment formula:

where

is the payment

is the payment

is the amount of the loan

is the amount of the loan

is the rate per period

is the rate per period

is the number of periods

is the number of periods

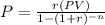

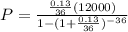

Option A. 13% interest for 36 months compounded monthly

We know form our problem that Ricky is taking out a personal loan for $12,000, so

. We also know that the term of the loan is 36 months, so

. We also know that the term of the loan is 36 months, so

. To find the rate per period, we first need to convert the interest rate to decimal form; to do it, we divide the rate by 100%:

. To find the rate per period, we first need to convert the interest rate to decimal form; to do it, we divide the rate by 100%:

. Now since the bank is charging him the interest rate for the 36 months, we just need to divide the interest rate (in decimal form) by the number of months (36) to find the rate per period:

. Now since the bank is charging him the interest rate for the 36 months, we just need to divide the interest rate (in decimal form) by the number of months (36) to find the rate per period:

.

.

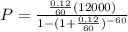

Now that we have all the vales we need, let's replace them in our formula

The monthly payment of loan A is $356.07

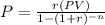

Option B 12% interest for 60 months compounded monthly

interest rate in decimal form =

Replace the values in formula:

The monthly payment of loan B is $212.44

Monthly payments of loan B are significantly low that monthly payments of loan A.

We can conclude that the correct answer is: a. More payments with the 60 month loan will give him the lowest monthly payment.