Answer:

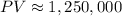

The correct option is b.

Explanation:

Given information:APR= 5%, Period = 20 years, Annual salary = $100,000.

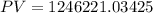

The formula for ordinary annuity is

![PV=(P[1-(1+r)^(-n)])/(r)](https://img.qammunity.org/2018/formulas/mathematics/high-school/tdi6b52ib761duo8pe2ao11q1z56t0nj37.png)

Where, P is periodic payment, r is rate per period and n is number of periods.

![PV=(100000[1-(1+0.05)^(-20)])/(0.05)](https://img.qammunity.org/2018/formulas/mathematics/high-school/kypfccxp74d9w9t4wqup77163ql3n7nflf.png)

Therefore the correct option is b.