Answer:

The monthly payment would be $1,937.12

Explanation:

1. Organize the data:

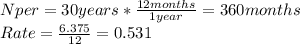

Initial Value= $345,000

Down Payment = 10% of Inicial Value

Nper (Number of payments)= 30 years

Rate = 6.375%

2. Down Payment

As it is 10% of the Initial Value, you could calculate it as is shown in the following:

10% =

= 0,1

= 0,1

10% *

= 0,1 * 345,000 = 34,500

= 0,1 * 345,000 = 34,500

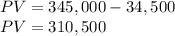

3. Present Value (PV)

The total amount that will be borrow is:

PV = Initial Value - Down Payment

4. Adequate the data: To determine the monthly payment is better adequate the Nper and Rate in months as following:

%= 0.00531

%= 0.00531

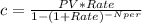

5. Apply the equation: Remember that the equation that calculate the payment for a loan based on constant payments is:

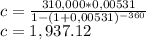

6. Perform the equation: Replace the numbers in the corresponding variables of the upper equation.

Finally, the monthly payment would be $1,937.12