I will be using present value notation of "v", where v is present value of 1 a year from now.

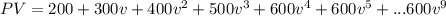

The series of payments looks like this:

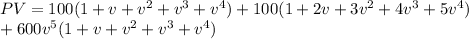

The first 5 payments form an increasing annuity, the last 5 form a standard constant annuity. The increasing part needs to be of the form 1,2,3...n. Since we have 2,3,4,5,6, subtract 1 from each term ---> (1,1,1,1,1) + (1,2,3,4,5).

Rearranging the equation gives:

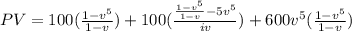

Now plugging in the sum formulas for geometric series and increasing series:

Finally sub in values using i = 5.5% = .055