Answer:

a. Loan Q’s finance charge will be $83.73 greater than Loan P’s.

Explanation:

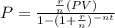

To solve this, we will use the formula for loan payment:

Here,

P is the payment ; PV is the present debt; r is the interest rate; n is the number of payments per year; t is the time

Working for bank P:

PV = 19450

r = 5.8 or 0.058

t = 9

n = 12

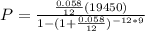

Putting the values in the formula we get:

Solving this we get:

P= $231.59

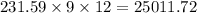

Dahlia's monthly payment is $231.59. So,her total payment for 9 years will be =

Finance charge will be = total future value minus loan amount plus service charge.

=

= $6486.72

= $6486.72

Hence, the total finance charge of bank P is $6,486.72

Working for bank Q:

PV = 19450

r = 5.5 or 0.055

t = 10

n = 12

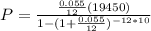

Putting the values in the formula we get:

Solving this we get:

P= $211.08

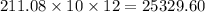

Dahlia's monthly payment is $231.59. So,her total payment for 10 years will be =

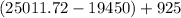

Finance charge will be =

Hence, the total finance charge of bank Q is $6570.45

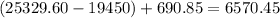

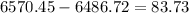

Now we will find the difference between both bank's finance charges:

dollars

dollars

So, we can say that Loan Q’s finance charge will be $83.73 greater than Loan P’s.