Answer:

$441,714.00

Explanation:

Cost of the home = $215,000

Period of the mortgage = 30 years

Rate of Interest = 5.5% = 0.055

PMI = $93.50/ month for 2 years

Total PMI = 93.50 * 24 = $2,244

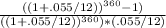

Mortgage amount to be repaid every month = 215000 divide by

= 215000/176.1218 = 1220.75

Total cost of the loan = 1220.75*360 + 2244 = 439470 + 2244

= $441,714

Hope it helps.

Thank you !!