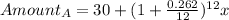

Let the required balance be

.

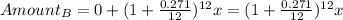

.

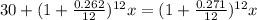

Thus, for Card A, which has an APR of 26.2% and an annual fee of $30, the amount after a year when compounded monthly will be:

........(Equation 1)

........(Equation 1)

Likewise, for Card B, which has an APR of 27.1% and no annual fee, the amount after a year when compounded monthly will be:

....(Equation 2)

....(Equation 2)

Therefore, all else being equal, the balance,

, at which the cards offer the same deal over the course of a year can be found by equating the equations 1 and 2 and solving for x.

, at which the cards offer the same deal over the course of a year can be found by equating the equations 1 and 2 and solving for x.

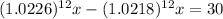

Thus we have:

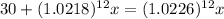

Simplification gives us:

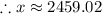

dollars

dollars

This is the closest to the second option. Thus, option B is the correct option.

Important Note: If we do not round off the intermediate steps and calculate it directly using a calculator then we will get the exact answer of option B which is: $2617.85.