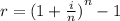

The effective rate is calculated in the following way:

where r is the effective annual rate, i the interest rate, and n the number of compounding periods per year (for example, 12 for monthly compounding).

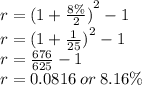

our compounding period is 2 since the bank pays us semiannually(two times per year) and our interest rate is 8%

so lets plug in numbers: