Principal amount = P = $1500

Time in years = t =10

For annual compounding, interest rate = r = 3% = 0.03

Amount accumulated = A

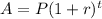

Formula for Annual(Yearly) compounding is:

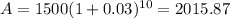

Using the values, we get:

Interest rate for continuous compounding = r = 2% = 0.02

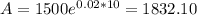

Formula for continuous compounding is:

Using the values, we get:

This means amount accumulated by yearly compounding after 10 years will be

$ 2015.87 and amount accumulated by continuous compounding will be

$ 1832.40. Therefore the amount with yearly compounding will have more amount by the end of 10th year. The difference in the two amounts will be $183.47. So the yearly compounding will have saved $183.47 more than continuous compounding.