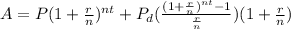

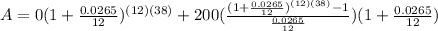

To solve this we are going to use the compound interest formula with periodic deposits:

where

is the final amount after

years

is the initial investment

is the periodic deposits

is the interest rate in decimal form

is the number of times the interest is compounded per year

is the time in years

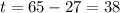

Since he is going to save from 27 years old until 65 years old,

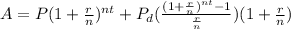

. We know that hes is opening his IRA with $0, so

; We also know that he is going to invest $200 at the beginning of each month, so

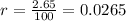

. To convert the interest rate to decimal form, we are going to divide it by 100:

, and since the interest is compounded monthly,

. Lets replace all the values in our formula to find

:

We can conclude that Rick will have $157,419.04 in his IRA account by the time when he retires.