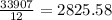

1. The annual salary of Tristan = $33907

So, his monthly salary becomes =

Semimonthly means he is paid twice in a month so his each paycheck will have the amount =

Hence, option C is the answer.

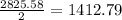

2. The cost of the meal = $75.77

Tip percent = 25%

So, amount of the tip is =

Hence, option B is the answer.

3. Rate of commission = 0.045

Equation becomes = 11.25t+0.045S (S is sales)

Putting 35 in t we get ,

P(35)=11.25(35)+0.045(4000)

= 393.75+180 = 573.75

Hence, option C is the answer.

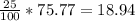

4. Total money earned for working 40 hours=

The social security tax is 6.2% of the gross pay, it becomes

or 38.69

or 38.69

Hence, option D is the answer.

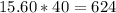

5. Total deductions are 472.05 - 296.15 = $175.90