Answer: $20

Explanation:

Given : The price of two DVDs after tax was added = $21.60 (1)

The sales tax rate= 8% = 0.08 [∵ To convert percent into decimal , we divide it by 100]

Let x be the cost of two DVDs ,

Then tax amount = sales tax rate x Cost of two DVDs

i.e. tax amount = 0.08x

Now , The cost of two DVDs after sales tax will be : Cost of two DVDs+ Tax amount

x+0.08x = (1+0.08)x =1.08x (2)

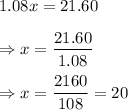

From (1) and (2) , we get

Hence, the cost of the two DVDs before the sales tax was added was $20 .