Answer:

Part 1 - option D is the answer.

Part 1:

Yasmine needs to contribute $9,000 annually to her education.

So, the best plan will be as follows:

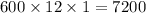

A. $600 per month for 1 year, amount becomes

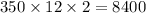

B. $350 per month for 2 years, amount becomes

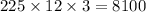

C. $225 per month for 3 years, amount becomes

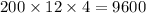

D. $200 per month for 4 years, amount becomes

We can see that plan D will save her required amount. Hence, option D is the correct answer.

Part 2:

Automatic withdrawal is the function given to account holders of any bank, where they can choose a particular date to auto debit their bill amounts.

Advantages are :

B). avoiding late payment fees

D). not having to find a stamp and a mailbox

Disadvantages are :

A). not having to keep track of the balance in a checking account(you surely have to check your bank positions timely )

C). having to share your account information

F). possible overdraft fees if there is not enough money in the account to cover the payment amount.