Answer: The required tax is $1551.00.

Step-by-step explanation: We are given that Jason Jones earns $55,000.00 and is married and the tax rate is 3%.

We are to calculate the tax, where the federal exemption is $3300.00.

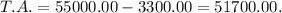

According to the given information, the taxable amount is given by

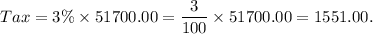

Since the tax rate is 3%, so the total tax is given by

Thus, the required tax is $1551.00.