Answer: $2,150,000

Explanation: Let

T = Total expenses of Joint-Serve

Then, before the company acquired robotic assemblers, the expenses allocated for payroll is given by

Expenses for Payroll = 43% of Total Expenses

Expenses for Payroll = 0.43T (1)

(Because 43% = 0.43)

Because the total expenses increased by $250,000 after spending for robotic assemblers, the total expenses = T + 250,000

So, the payroll expense is now calculated as

Expenses for Payroll = 38% of Total Expenses

Expenses for Payroll = 0.38(T + 250,000) (2)

(Because 38% = 0.38 and total expenses = T + 250,000)

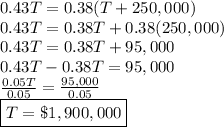

By comparing equations (1) and (2),

Thus, the total expense before the purchase of robotic assemblers is T = $ 1,900,000. Therefore, the total expense after purchasing the robotic assemblers is T + 250,000 = 1,900,000 + 250,000 =

$2,150,000