Answer-

The extra cost paid by taking this deal is equivalent to actual yearly rate of interest 36%

Solution-

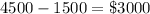

Price of truck = $4500

John made a down payment of $1500, so the present value of annuity will be,

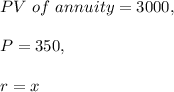

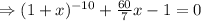

We know that,

![\text{PV of annuity}=P[(1-(1+r)^(-n))/(r)]](https://img.qammunity.org/2019/formulas/mathematics/middle-school/ssuc4asmzf2xpno5h61xf3mz7met153lj6.png)

Putting the values,

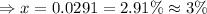

![\Rightarrow 3000=350[(1-(1+x)^(-10))/(x)]](https://img.qammunity.org/2019/formulas/mathematics/college/op59zhzw4ymscjtjsvavpkyqlcfq5knfos.png)

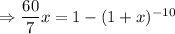

![\Rightarrow (3000)/(350)=[(1-(1+x)^(-10))/(x)]](https://img.qammunity.org/2019/formulas/mathematics/college/7yvaqs51twwu5q0zb43tjqwsanctsi0ggv.png)

Using calculator we get,

Therefore, annual interest will be,