Solution:- Answer is 19.33%

Annual percentage rate (APR) is the yearly rate for a price which have to pay for borrowing money through credit card.

Here Caleb has an offer from a credit card issue for i=0% APR for the first 30 days.

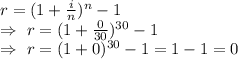

now, effective interest rate for n= 30 days

=

After 30 days APR =17.68%=0.1768

n=365-30=335 days

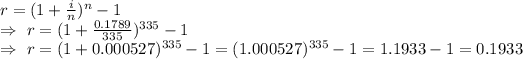

now the effective interest rate for n=335 days

=

=19.33%

So the effective interest rate for 365 days =0+19.33% =19.33%

So fourth option is correct.