First step, find the monthly payments.

Borrowed amount, P = 210000

Monthly interest, i = 0.045/12

Number of periods, n = 30*12=360

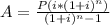

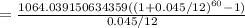

Monthly payment

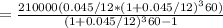

[to the 1/100 of a cent]

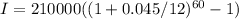

2. Calculate interest accumulated over 60 months

3. Calculate value of payments

to the nearest cent

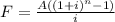

4. Calculate percentage of interest paid

A. as a fraction of future values

Percentage of interest

=52877.12/71445.50

=74.01%

As a fraction of total amounts paid

Percentage of interest

=52877.12/(60*1064.0392)

=52877.12/63842.35

=82.82%