Answer : The maturity value of a loan is, $7103.73

Step-by-step explanation :

Given:

Principle = $6787

Rate = 14 % per year

Time = 4 months =

First we have to determine the simple interest.

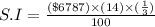

Formula used :

where,

P = principle

R = interest rate

T = time

S.I = simple interest

Now put all the given values in the above formula, we get:

Now we have to calculate the maturity value of a loan.

Maturity value of a loan = Principle + Simple interest

Maturity value of a loan = $6787 + $316.73

Maturity value of a loan = $7103.73

Thus, the maturity value of a loan is, $7103.73