Given pension plan:

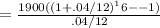

Quarterly payment, A = 1900

Interest per quarter, i = 0.04/12

Number of quarters, n = 40*4 = 160

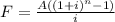

Future value of pension (after 40 years)

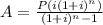

As of retirement,

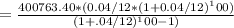

Present value of pension, P = 400763.40

Interest per quarter, i = 0.04/12

Number of quarters, n = 25*4 = 100

Amount of payout, A, per quarter

(to the nearest cent)