Answer: Since Frank made his most recent EMI payment today, Frank needs 76,136.52 in order to pay off his mortgage today.

We follow these steps to arrive at the answer:

We first calculate the EMI on loan taken out:

The EMI is nothing but P (constant amount paid or received periodically) in the Present Value of an Annuity formula. The formula is

![\mathbf{PV_(Annuity) = EMI* \left[ (1 - (1+r)^(-n))/(r) \right]}](https://img.qammunity.org/2019/formulas/business/college/2s71wugneb14tcujniazifq63obi0y907k.png)

Substituting the values from the question we get,

150000 = EMI* \left[ \frac{1 - (1+\frac{0.05}{12})^{-(25*12)}}{\frac{0.05}{12}} \right]

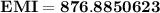

Solving we get,

![150000 = EMI* \left[\171.06\right]](https://img.qammunity.org/2019/formulas/business/college/9cxihn3tovhkcuu7rnsvfy1trv09t47vgd.png)

We then construct the Amortization table attached below. At the end of 16 years or 192 periods (

), we can see that the principal outstanding is $76,136.52.

), we can see that the principal outstanding is $76,136.52.