Answer:

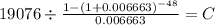

The exact monthly payment will be $465.66

From the given options: OD is the most closer

Explanation:

We got the following situation:

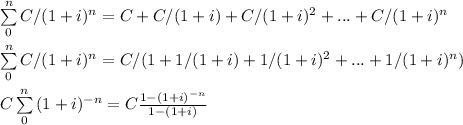

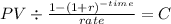

We end up with the formula for the present value of an annuity.

PV $ 19,076.00

time 48

rate (0.07966 / 12 months) 0.006663333

C $ 465.66509