Answer:

4.66 years

Explanation:

Let us assume that it will take 't' years for him to repay the money that he would borrow.

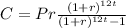

We can use monthly cashflow formula:

Here, we have been given:

Monthly cashflow C=425

Loan amount P=20000

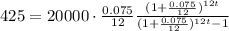

Interest rate AMR = 7.5%. Therefore, we have

Upon substituting these values in the formula, we get:

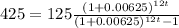

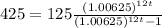

Upon simplifying, we get:

Upon solving this equation using a calculator, we get:

Therefore, correct answer is 4.66 years. That is, second choice from the given options.