Answer:

Fernando will pay $102.114.

Explanation:

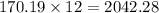

If Fernando's gross income should be deducted $170.19 per month for life insurance, then he should be deducted =

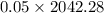

As given, that his employer covers 95% of this amount, Fernando only needs to pay 5% for life insurance.

Getting 5% of $2042.28 we have,

= $102.114

= $102.114

Therefore, Fernando will pay $102.114.