Answer:

Option C (6.47%) is the right answer.

Step-by-step explanation:

The given values are:

New machine's cost,

= $1,000,000

Net revenue,

= $150,000

Time,

= 9 years

MAAR,

= 10% per year

Now,

On taking, i = 5%

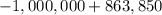

⇒ PW(5%) =

=

=

On taking, i = 10%

⇒ PW(10%) =

=

=

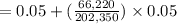

By interpolation, we get

⇒

![i=5 \ percent + [(66,220-0)/((66,200-(-136,150)) ]* (10 \ percent - 5 \ percent)](https://img.qammunity.org/2022/formulas/business/college/ssdfx7nwt40bbp7f3v5v19na1xj0wrifyf.png)

⇒

⇒

i.e.,

⇒