Answer:

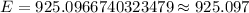

$925.097.

Explanation:

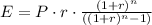

We will use EMI formula to answer our problem.

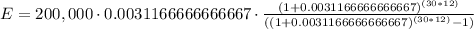

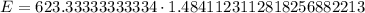

, where,

, where,

E is EMI.

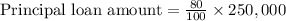

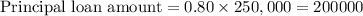

P= Principal loan amount.

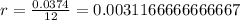

r= the rate of interest calculated on monthly basis.

We need to figure out our principal loan amount before using this formula. We are told that we have to pay 20% of $250,000 as down payment, therefore our principal loan amount will be 80% of $250,000.

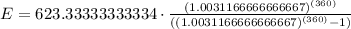

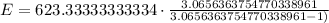

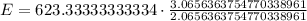

Now let us use EMI formula to find our mortgage payment.

Therefore, the mortgage payment to cover remaining balance in 30 years will be $925.097 per month.