Answer:

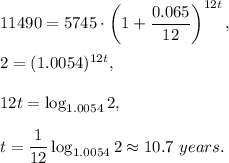

1. 10.7 years

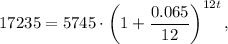

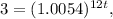

2. 17.0 years

3. 2nd option

Explanation:

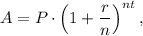

Use formula for compounded interest

where

A is final value, P is initial value, r is interest rate (as decimal), n is number of periods and t is number of years.

In your case,

1. P=$5745, A=2P=$11490, n=12 (compounded monthly), r=0.065 (6.5%) and t is unknown. Then

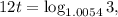

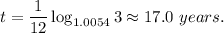

2. P=$5745, A=3P=$17235, n=12 (compounded monthly), r=0.065 (6.5%) and t is unknown. Then

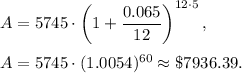

3. 1 choice: P=$5745, n=12 (compounded monthly), r=0.065 (6.5%), t=5 years and A is unknown. Then

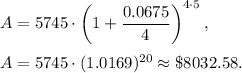

2 choice: P=$5745, n=4 (compounded monthly), r=0.0675 (6.75%), t=5 years and A is unknown. Then

The best will be 2nd option, because $8032.58>$7936.39