Answer:

650396.82$ must be deposited to make the annuity payment of 50000 for 20 years.

Explanation:

Given Periodic payments, PMT=50,000$ every year for 20 years.

And deposited amount is compounded annually with 4.5% interest rate.

And interest rate,

, where m= number of payments in a year=1 here.

, where m= number of payments in a year=1 here.

And time period, n=20

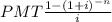

The amount deposited is nothing but present value.

Hence PV=

=

=$650396.823≈$650396.82