the loan is being amortized, so that doesn't matter for its future value, the simple case that the borrower is paying it in bits monthly.

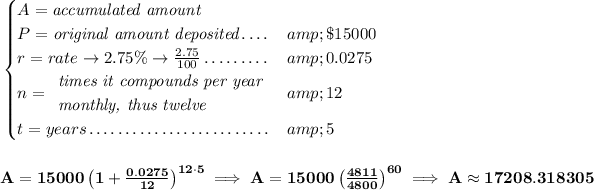

so, we're really just looking for the future value of the Principal $15000, let's convert theat mixed fraction to improper fraction, and then to a percent format firstly.

![\bf \stackrel{mixed}{2(3)/(4)}\implies \cfrac{2\cdot 4+3}{4}\implies \stackrel{improper}{\cfrac{11}{4}}\implies \stackrel{decimal}{2.75} \\\\[-0.35em] ~\dotfill\\\\ ~~~~~~ \textit{Compound Interest Earned Amount} \\\\ A=P\left(1+(r)/(n)\right)^(nt)](https://img.qammunity.org/2019/formulas/mathematics/middle-school/sx3lwr2xemmxuzc47el90w9imsxlla6u3q.png)

how did we get 4811/4800? well, is really just the 1+(0.0275/12), which gives us about 1.0022917 but is a repeating decimal, so 4811/4800 is just the fraction version of it.