Answer:

The amount withheld yearly for state income tax is 1045.50

Explanation:

Kariz Johnson earns 34850 annually as an engineer.

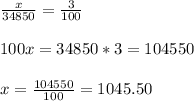

Suppose, the amount of yearly state income tax is

The state tax rate in her state is 3% of taxable income. That means, if the taxable income is 100, then the amount of tax is 3.

So, according to the ratio of "amount of tax" and "amount of income" , the equation will be......

Thus, the amount withheld yearly for state income tax is 1045.50